March 02, 2023

Summary of SUSS NiFT Seminar 'The Evolution of Bitcoin Economics'

On Feb. 8, a seminar “The Evolution of Bitcoin Economics” was presented by Jack Lee and Sherry Lin from HCM Capital in partnership with SUSS Node for Inclusive Fintech for bringing participants back to the fundamentals of Bitcoin as well as its evolutionary change.

The presentation was mainly divided into the following five sections:

1. Misperceptions of Bitcoin

It is widely acknowledged that Bitcoin is a type of crypto. However, in Lin’s point of view, Bitcoin is not “Crypto” because it is first scarce while cryptos like ETH and Dogecoin have unlimited supply. It is reasonable that one thing can not be a currency if it has a fixed supply. Second, Bitcoin is decentralized and backed by energy while cryptos are backed by Venture Capitals or their business model. For example, Solana is backed by a16z, Polychain Capital, Multicoin Capital, etc. There are keyman risks for those centralized systems which were just proved by SBF and FTX collapse. For Bitcoin, it is a leaderless system of rules and extremely hard to be manipulated. Bitcoin will be more stable as the crypto market grows and more people adopt Bitcoin.

2. The Evolutionary Change

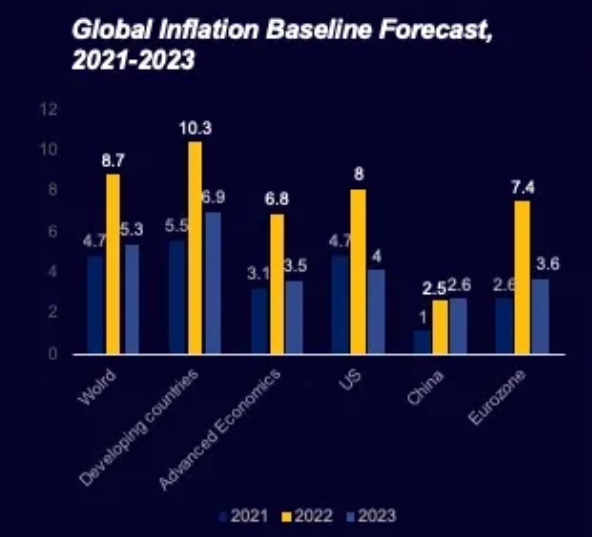

Lee introduced this part by comparing two types of money: Government money(Fiat) and Sound money. Sound Money is Gold standard which has features of low time preference, free of government control, self-correcting mechanisms inherent in a free-market system, fixed supply and ability to be transferred at anywhere anytime. Bitcoin is the digital form and will be sound money. Lee also pointed out that we are living in an inflationary decade and the purchasing power of any fiat has decreased inevitably and sharply due to inflation and money supply. That’s why Bitcoin/Sound money can be a solution to make up for falls in people’s wealth in this inflationary period. Lee also argued about sovereignty and analyzed the needs and importance of individual sovereignty to society and economy.

3. A Borderless World

Bitcoin will enable a world without economic borders, that is, it will be a global currency for people and lightning will probably be the way of payment. It is an opportunity for Bitcoin to build a borderless financial system for nearly 1.7 billion unbanked people and secure more than 1.2 trillion of transaction value on global remittance.

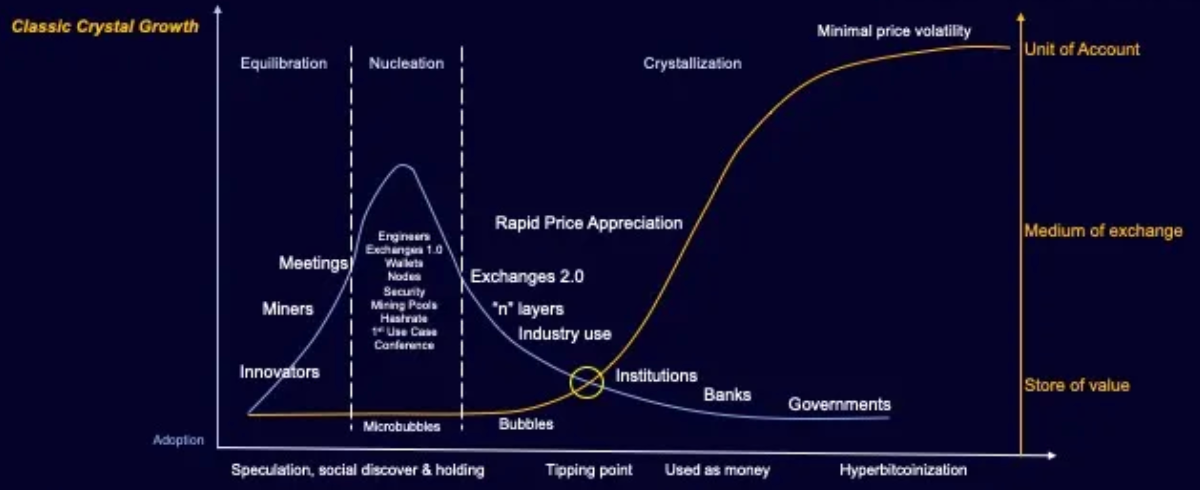

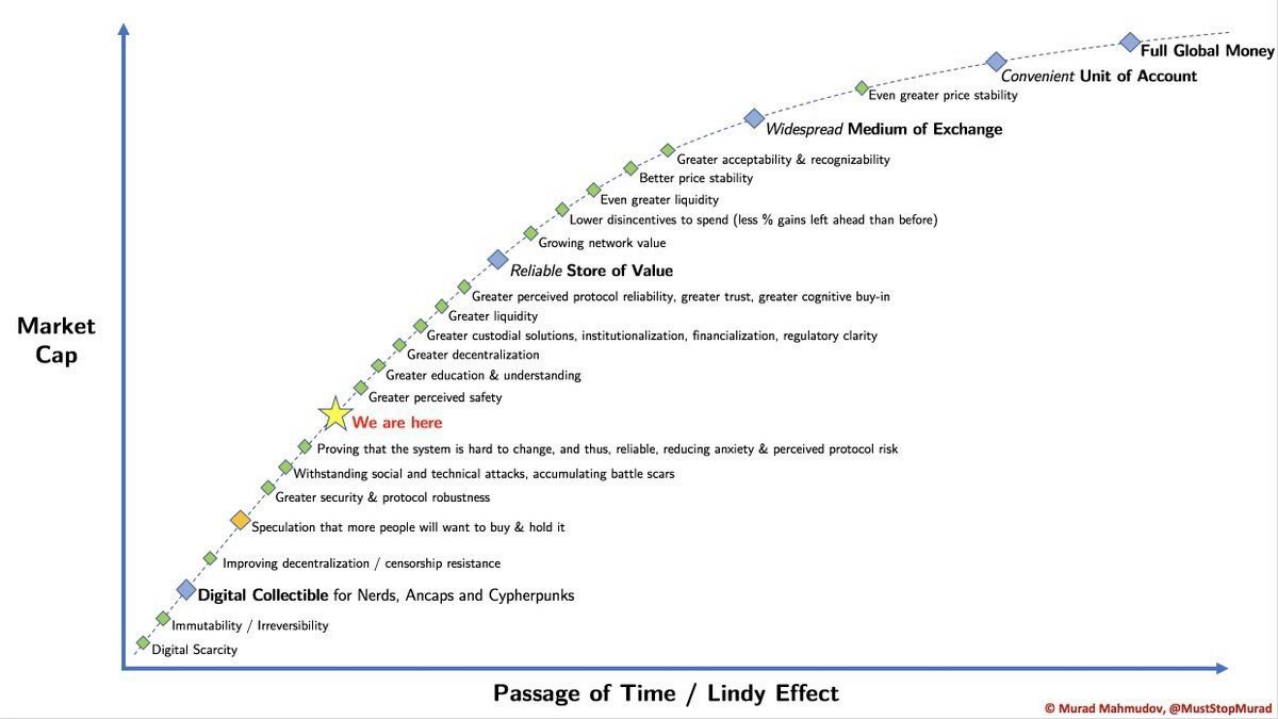

4. Bitcoinization

From the perspective of Lindy effect and network effect, Bitcoin is here to thrive. Bitcoin in 2021 had approximately the same number of users as Internet in 1997. The bitcoin adoption grows fast and will have around 1 billion users in 2025 if it grows like Internet. In the future, Bitcoin adoption will reshape banks and governments to arrive its final state: Hyperbitcoinization, a voluntary transition from fiat to bitcoin.

5. The Business Landscape of Bitcoin

As the figure shows, a positive feedback cycle exists in Bitcoin and crypto market. The more invest users put, the stronger the cycle is. To our excitement, the number of holders with over 1 Bitcoin is almost doubling every year, and the amount of institutions holding over 1,000 Bitcoin has increased by over 50% since 2019.

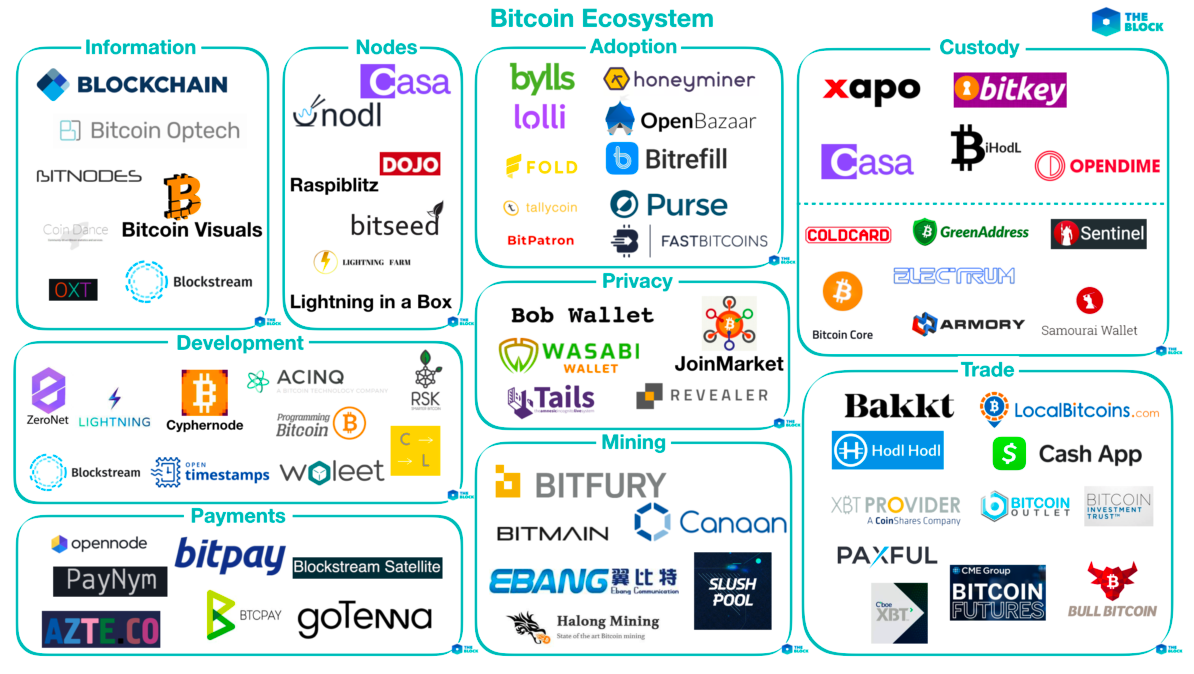

The Bitcoin ecosystem is thriving. The payments and trade service attracts more than 100 million users in total. The development section is responsible for Bitcoin protocol upgrade and the development of different lightning networks.

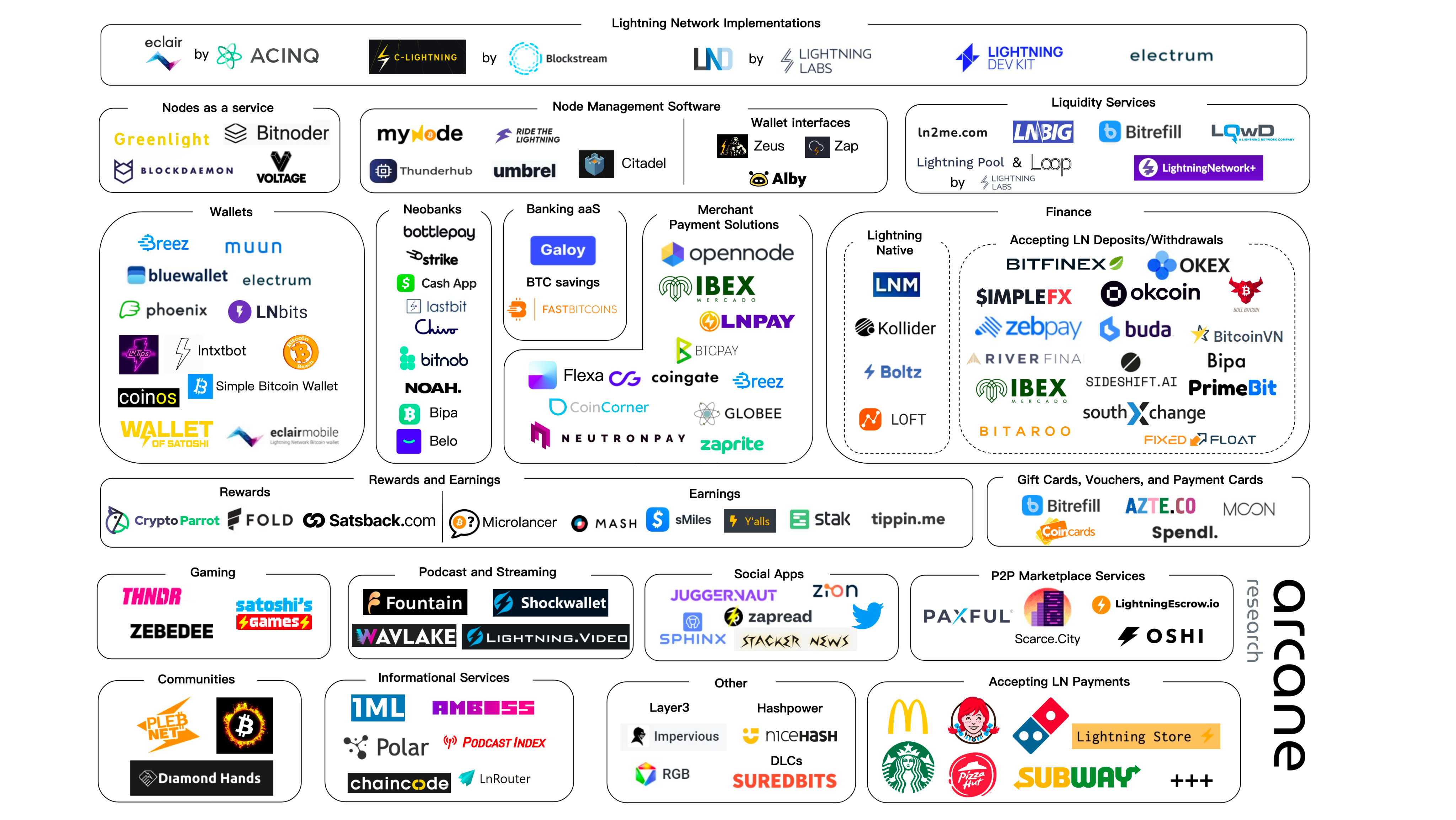

The public capacity on the Bitcoin Lightning Network grew exponentially from April through September in 2021 and the number of users with access to Lightning payments has increased to more than 47 million in Oct. 2022. Statistics of 2023.2.8 has shown that the lightning network capacity was more than 5501.28 BTC and there were 17,139 lightning network nodes. It is exciting to see more and more users have access to the lightning network and use BTC as their currency.

The information in this article is for educational purposes and not a financial advice. If you wish to invest in cryptocurrency, please seek professional views and these investments are high-risk and complex instruments.

Related Project

Related Project Secure Score

Guess you like

Beosin and HashPort Have Strengthened Strategic Partnership

March 03, 2023

Blockchain Security Monthly Recap of February: $56.88M lost in attacks

March 02, 2023

How to Avoid Issues Related to Deflationary Tokens

March 03, 2023

Blur's FOMO effect heated up NFT marketplaces. What do we need to know about investing in NFT?

March 14, 2023