March 22, 2024

The outbreak of BOME! Analysis of the MEV issues behind Solana meme season

Meme tokens in the Solana ecosystem have been the focus of the market recently. BONK, Dogewifhat or some deliberately misspelled celebrity meme tokens have become the targets of crazy pursuit by crypto users. Dogewifhat is even listed on Robinhood Crypto and Binance, with a market value of over $3 billion. On March 15, the BOME token launched by crypto artist Darkfarms increased more than 47 times in 24 hours, with transaction volume exceeding $300 million.

The problem that comes with the meme craze is that when users purchase meme tokens on the decentralized platform of the Solana chain, they are frequently subjected to sandwich attacks , resulting in high prices for meme tokens and losses. This type of robot is a MEV attack. What is MEV? What impact does it have on the blockchain ecosystem? How does Solana deal with issues caused by MEV? Today Beosin will analyze it one by one for everyone.

MEV and trading opportunities

MEV stands for Maximal Extractable Value, which is translated as the maximum extractable value. Initially MEV refers to Miner Extractable Value. In the BTC network, miners obtain rewards beyond block and network fees by reordering transactions in blocks . But in fact, MEV has nothing to do with the type of blockchain network. All public chain networks actually have similar situations, so MEV has expanded from Miner Extractable Value to Maximal Extractable Value.

MEV is like a tax that is collected by the maintainers of the entire blockchain network from ordinary users who use the network. This may seem like a burden, but MEV plays an important role in the development of blockchain networks and the stability of the ecological economy.

Since miners/validators can reorder transactions within a block, MEV is often used in the following strategies:

1. Atomic Arbitrage

If an arbitrageur finds that there is a price difference for the same trading pair in different liquidity pools on the chain, the arbitrageur will use MEV to strive for their transactions to exist in the same block to make a profit. This arbitrage behavior can balance the asset prices of different liquidity pools,

2. Liquidation

When it comes to on-chain lending business, bad debts are not avoided. Lending protocols often allow third-party liquidators to participate in liquidating collateral and maintain the stable operation of the protocol by liquidating unhealthy margin positions . For example, MakerDAO, if users mortgage ETH and other assets for borrowing, MEV robots will be responsible for liquidating and making profits.

3. Sandwich attack

The price calculation mechanism of AMM is used to preempt the purchase transactions of ordinary users, buy before the victim in a block, and then sell before the victim to make a profit.

There are other profitable activities such as IDO, INO preemptive purchase of tokens, minting NFT, etc., and MEV can also be used to make profits.

Solana MEV

Solana is similar to public chains such as ETH and uses PoS to ensure security. Due to the extremely high requirements for Solana's node operation, ordinary users cannot run Solana's verification nodes. Most of Solana's validation nodes are located in data centers that handle massive amounts of data. Validation nodes hosted in data centers can take advantage of network advantages and parallel design to process more transactions and obtain more block rewards.

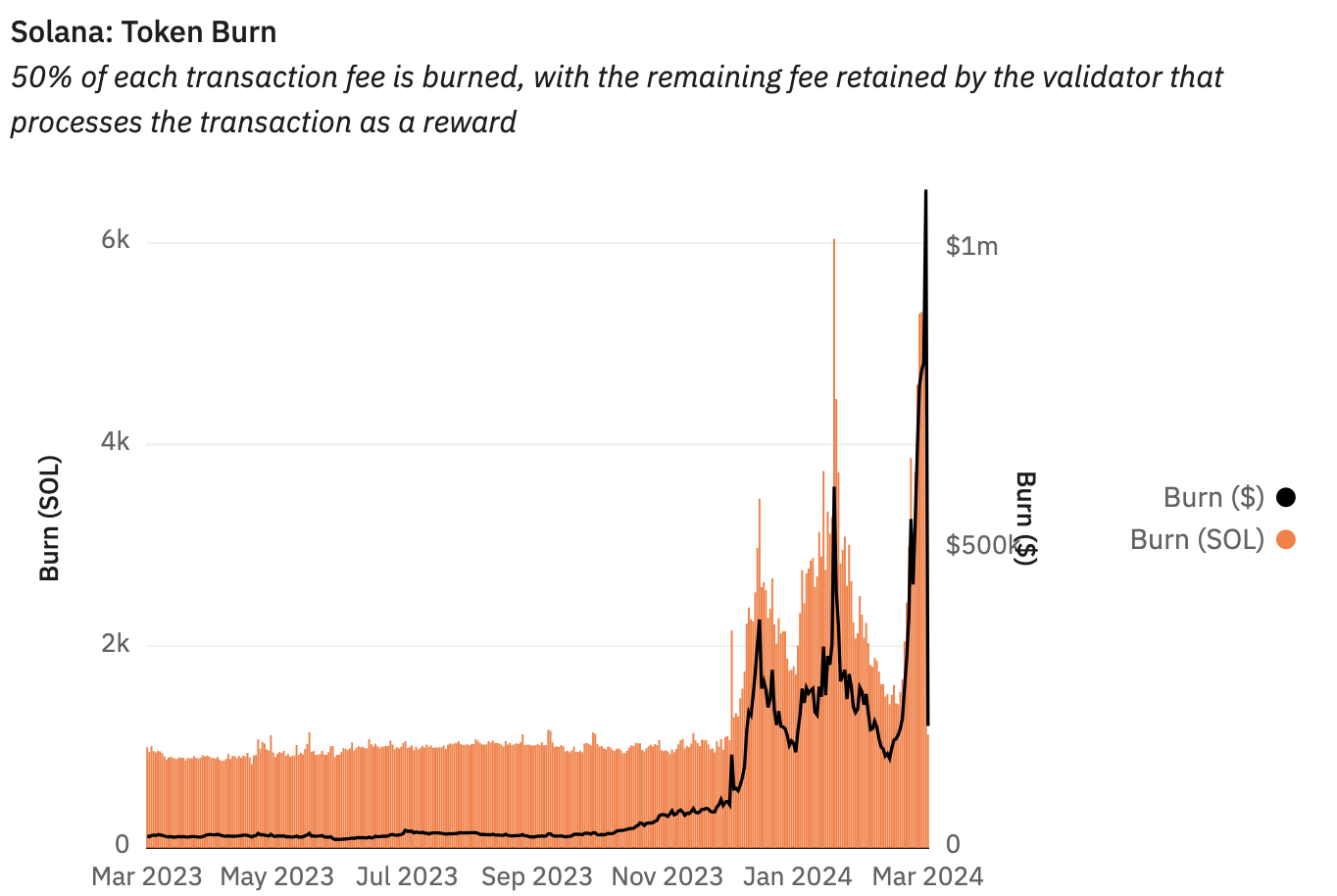

50% of all transaction fees collected by validators are required to be burned . The purpose of this is to incentivize validators to process as many transactions as possible within the allotted period.

On Solana, a block is produced approximately every 400 ms. Previously, due to Solana's first-come-first-out transaction processing mechanism, to utilize MEV, you had to compete for low latency rather than high fees . Being able to read the block state first means being able to execute profitable transactions with a higher probability.

Previously, to use MEV on Solana, you needed to run a node to read the latest network status and be a high-stake validator. This solution is demanding and costly.

Solana front-running strategy

1. Spam transactions

Previously, due to Solana's first-in-first-out transaction processing mechanism, spam transactions have always been the most common way to get ahead of the game . This method is not valid on Solana. Many people have used this method to make profits on Friend.tech of the Base chain . However, this method requires the verifier to process a large number of failed transactions. In severe cases, it may overload the verifier's processing capacity, lead to inconsistent consensus, and finally force the network to interrupt.

2. Prioritize gas fees

Prioritized gas fees are part of a new upgrade to Solana designed to address and reduce transaction spam by creating new incentives for transaction priority. The priority gas fee determines priority inclusion in blocks (a more costly method) based on the level of gas, thereby helping to reduce spam transactions.

Introducing this mechanism will increase the cost of generating spam transactions. However, the priority gas fee needs to always be high enough to ensure that spamming senders actually incur significant costs.

Additionally, the introduction of priority gas fees enables users to express their desire for priority confirmation of transactions in a fair and competitive manner . This mechanism of Solana is actually similar to Ethereum. We can see Solana’s gas war:

3. Jito-Solana

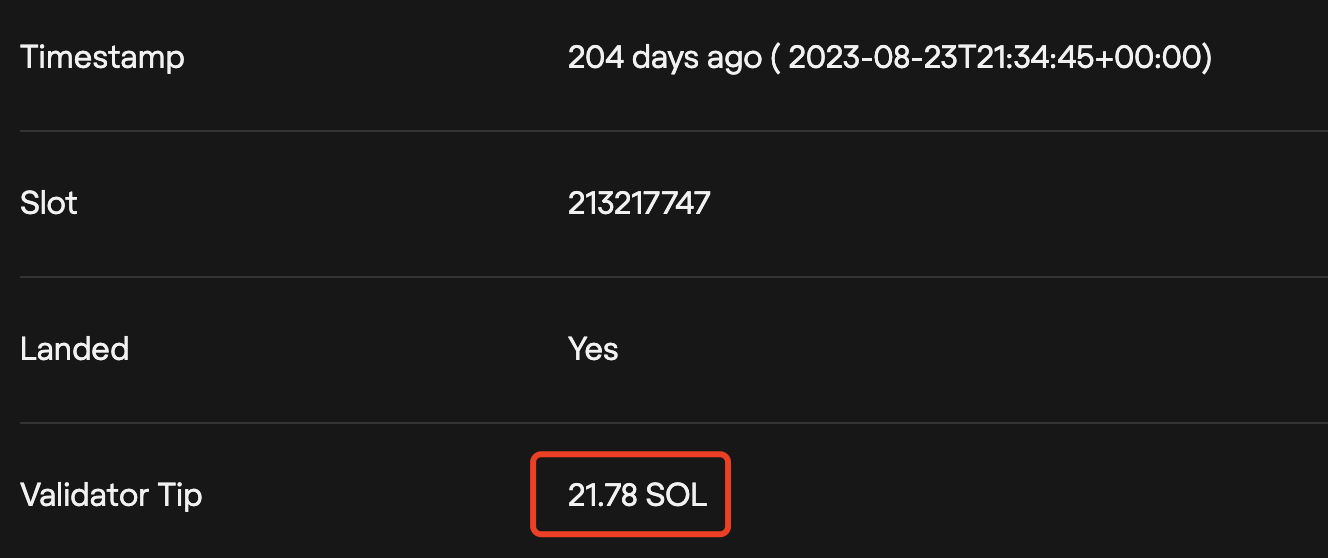

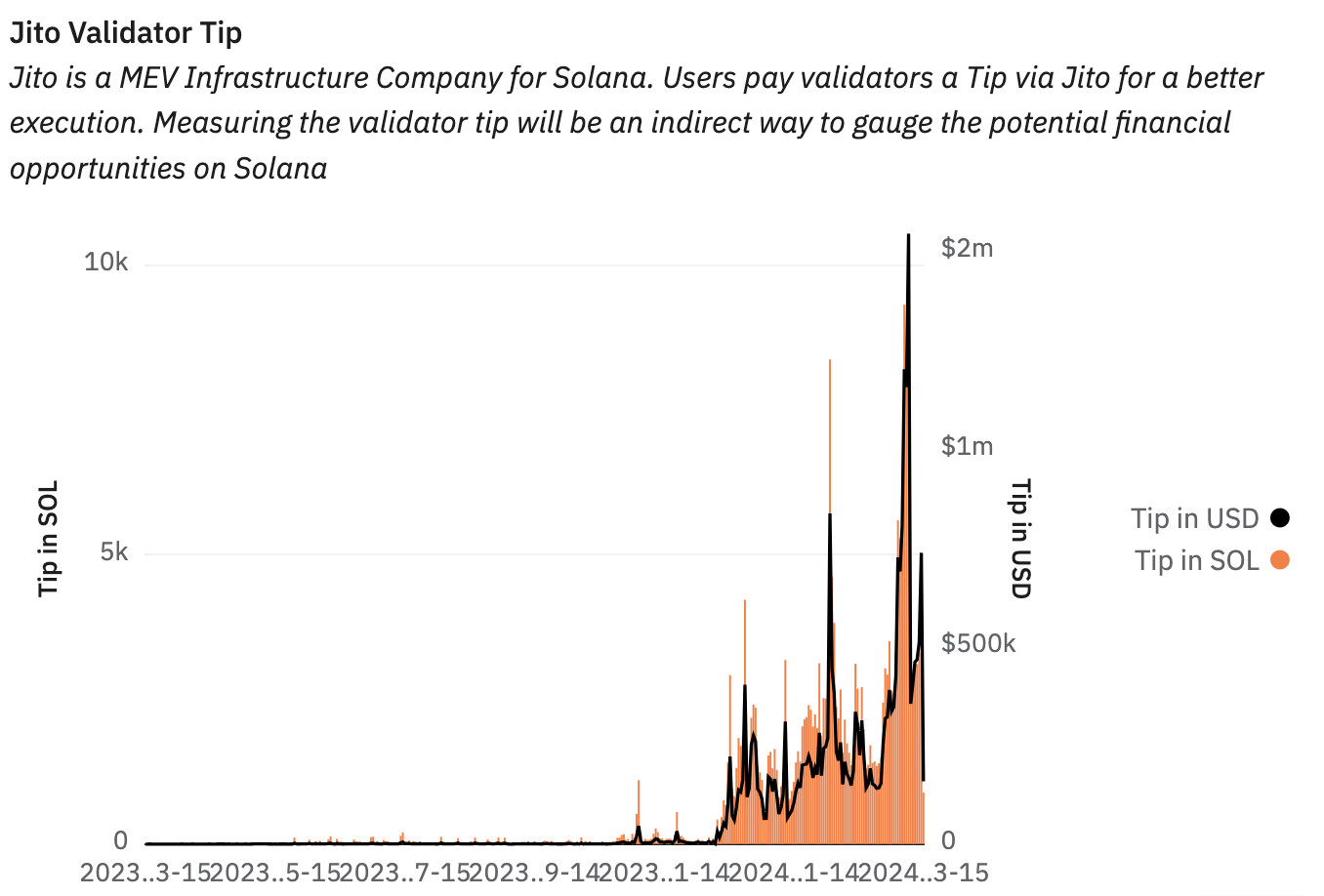

Jito-Solana is like Solana's Flashbot. By introducing mempool and block space auction mechanisms , users submit the transaction packages they want to be included in the block and the bid client for these packages to the validator running Jito-Solana. The highest bidder wins and their bundle is committed on-chain, creating an additional revenue stream for validators and their stakeholders. 100% of the tips paid are paid to the verifiers and their stakers:

At present, Jito-Solana client has accounted for 66% of the verification node client market share, becoming Solana's mainstream verification client . The validator MEV rewards and the number of validators using the Jito client (currently 814) indicate that more and more Solana participants are considering or are already practicing how to use MEV to capture/distribute profits on Solana.

In this Solana meme season, sandwich attacks launched through Jito have made ordinary users miserable. Jito has announced that it would temporarily close its mempool to reduce sandwich attacks:

What's your opinion on MEV?

MEV is not something that can really be eliminated. The focus of MEV research should be on how to use MEV to benefit ordinary users and applications in the Web3 ecosystem. For example, Jito guides Solana validators to choose its clients through MEV, increasing the diversity of Solana clients. Of course, currently due to its network effect, it has led to another centralization issues. We can use MEV to save the assets of users and projects and use MEV to redistribute the benefits generated by blockchains. These are all aspects of MEV that are beneficial to the entire Web3 ecosystem.

As one of the first blockchain security companies in the world to engage in formal verification, Beosin focuses on the "security + compliance" solution. It has offices in 10+ countries and regions and provides "All-in-One" blockchain compliance products + security services covering Smart Contract Audit, On-chain Risk Monitoring & Blocking, Crypto Tracing, Virtual Asset Anti-money Laundering (AML), and Compliance Assessments to meet regulatory requirements.

Related Project

Related Project Secure Score

Guess you like

From SBF to CZ, why crypto trading institutions are always accused of money laundering

March 22, 2024

Analysis of Blast DeFi Project Munchables Hack

March 28, 2024

2024 Q1 Global Web3 Security Report, AML Analysis & Crypto Regulatory Landscape

April 01, 2024

Beosin launches a new security + compliance solution to protect the Bitcoin ecosystem

April 22, 2024